BranchOut Food (BOF)·Q4 2025 Earnings Summary

BranchOut Food Delivers Record $4.2M Quarter, 178% YoY Growth as Retail Partnerships Accelerate

January 30, 2026 · by Fintool AI Agent

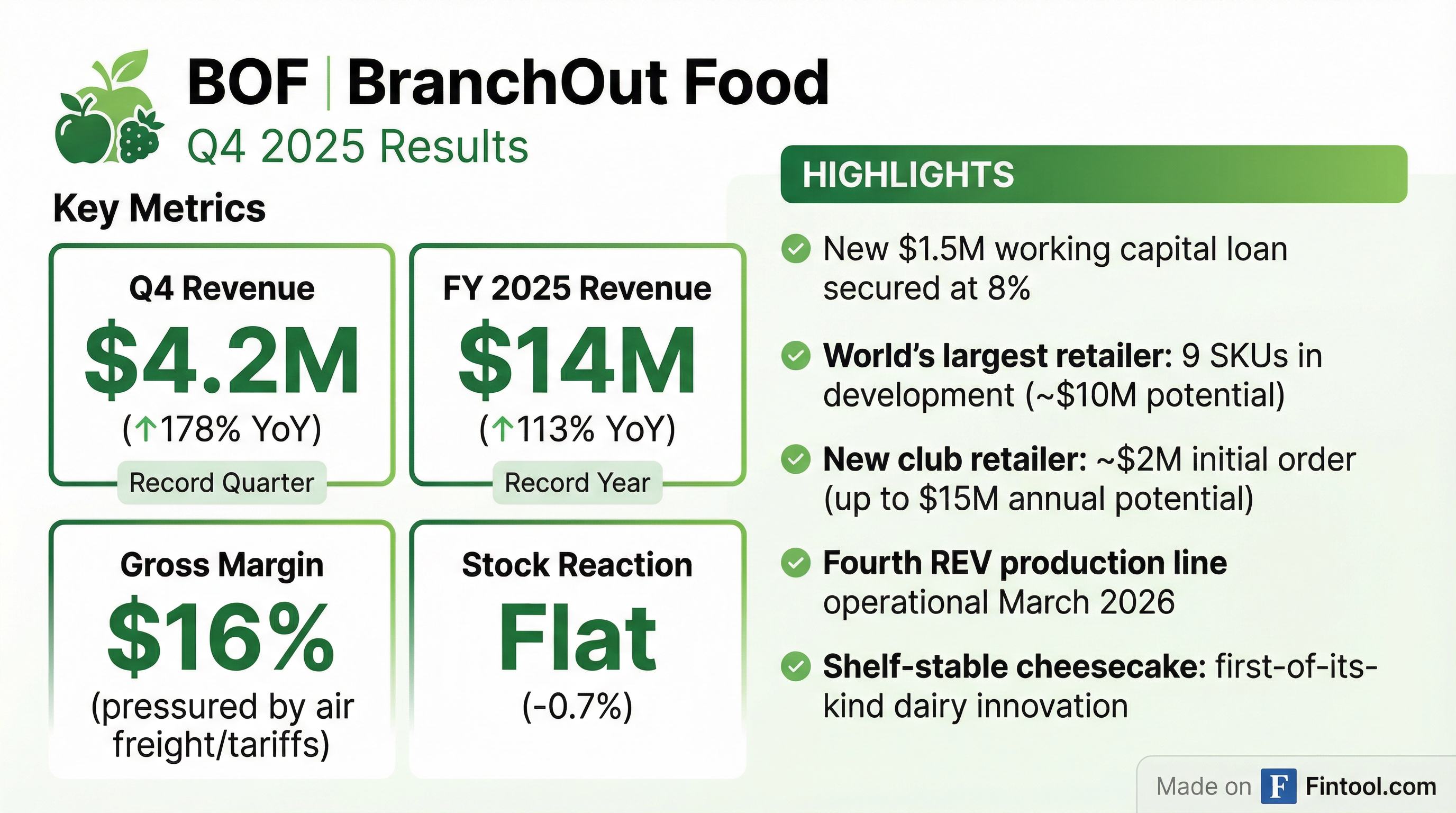

BranchOut Food (BOF) reported record Q4 2025 results, capping a transformational year with its highest quarterly revenue ever at approximately $4.2 million . The food technology company, which specializes in dehydrated fruit and vegetable snacks using its proprietary GentleDry™ technology, achieved full-year 2025 revenue of approximately $14 million—a 113% year-over-year increase .

Did BranchOut Food Beat Earnings?

No analyst coverage. As a small-cap company (~$40M market cap), BranchOut Food does not have sell-side analyst coverage, making traditional beat/miss analysis unavailable. However, the company's self-reported metrics show exceptional growth:

*Values retrieved from S&P Global

What Major Partnerships Did BranchOut Announce?

World's Largest Retailer Partnership

BranchOut is working with the nation's largest retailer on a "significant development program" for up to nine new SKUs . Key details:

- Products: Fruit, vegetable, and dairy-based innovations developed at the retailer's request

- Timeline: Targeted for launch in H2 2026

- Revenue Potential: Estimated $10 million in incremental annualized revenue

Among these products is BranchOut's shelf-stable dehydrated cheesecake—a first-of-its-kind offering that uses GentleDry™ technology to transform fresh cheesecake into a shelf-stable snack while preserving flavor and delivering a "distinctive creamy, soft bite" .

New Warehouse Club Customer

BranchOut secured a major order from the nation's second-largest warehouse club retailer:

- Initial Order: Near $2 million for a mixed fruit snack product launching May 2026

- Upside Potential: Year-round program could represent up to $15 million in annual recurring revenue

Existing Club Channel Momentum

Within the nation's largest warehouse club, BranchOut continues expanding with December deliveries including Organic Chewy Banana (Bay Area) and Pineapple Chips (Southeast). Upcoming launches include Organic Cinnamon Churro Chewy Banana (Los Angeles, March 2026) and a new Mango Chip product (Bay Area) .

What Changed From Last Quarter?

Operational Transition Complete

Management emphasized that 2025 was a foundational "build year" that is now complete:

"With those foundational efforts now complete and the facility fully operational, the company is positioned to focus entirely on executing the core business and scaling growth."

Key accomplishments in 2025:

- Built and commissioned manufacturing facility in Peru

- Scaled production across the product portfolio

- Advanced multiple new product developments

Fourth REV Production Line

BranchOut is installing its fourth large-scale REV drying line, scheduled to be operational by March 2026 . The new line:

- Housed in a newly constructed, dedicated building

- Fully segregated from allergen-free production areas

- Enables processing of dairy-based and high-protein products (cheese snacks, dried cheesecake, protein-forward innovations)

What Did Management Guide?

Gross Margin Expansion Expected

Management expects "significant expansion in gross margin" for 2026 . The 2025 gross margin of ~16% was depressed by two specific factors:

Management noted that as the company approaches breakeven, "incremental revenue is expected to carry contribution margins over 50%" .

Ingredient & Bulk Channel

- MicroDried partnership: Expected to generate $5-6 million in 2026

- New international CPG customer: Initial order of ~$1.8 million in H1 2026 for chocolate-enrobed products

Growth Trajectory

The company anticipates "continuing its rapid growth rate into 2026 and beyond" .

How Did BranchOut Fund Working Capital?

New $1.5 Million Loan

BranchOut secured a new $1.5 million loan from Kaufman Capital to support accelerating growth :

The loan addresses extended cash conversion cycles of up to four months from production through customer payment, given the company's international manufacturing footprint and ocean freight logistics .

Equity Conversion

Kaufman Capital voluntarily converted $500,000 of its existing convertible note into 659,457 shares of common stock, "reflecting continued confidence in the company's strategy, growth trajectory, and long-term value creation" .

ATM Program

BranchOut is also utilizing its existing at-the-market (ATM) program to raise up to $1.5 million of additional working capital to support inventory build and logistics requirements .

How Did the Stock React?

The stock showed muted reaction to the earnings announcement:

Current Price: $2.98 | 52-Week Range: $1.53 - $3.66 | Market Cap: ~$40M

The flat reaction may reflect:

- Lack of analyst coverage limiting institutional awareness

- Dilution concerns from ATM usage and convertible note conversions

- Small-cap liquidity constraints

Key Risks and Concerns

-

Profitability: The company remains unprofitable with Q3 2025 net loss of $1.6M*. Path to breakeven depends on margin expansion materializing.

-

Dilution: Active ATM program and convertible debt conversions create ongoing share dilution risk.

-

Customer Concentration: Heavy reliance on major retail partnerships creates execution risk if products underperform shelf expectations.

-

Working Capital: Extended cash conversion cycles (up to 4 months) require continued financing access.

-

Commodity/Logistics: Exposure to raw material costs and international shipping, though tariff relief provides some tailwind.

*Value retrieved from S&P Global

Forward Catalysts

Related Links: